|

A summer camp taking place in Memphis is trying to break barriers and help close the wealth gap in Shelby County.It’s a three-week boot camp where students learn about the stock market and learn skills to become successful in their future finances.

This week was 15-year-old Imsety Ayetoro’s first time stepping foot on a college campus. “It feels so amazing," said Ayetoro. "It feels like you know, I’m growing up.” The teen from Whitehaven is in the Young Wallstreet Traders camp being held at the University of Memphis. Read more at WREG.com.

2 Comments

“It is easier to build strong children than to repair broken men.”

That was the Frederick Douglass quote that Memphis Director of Youth Services Ike Griffith used to welcome participants to RedZone Ministries’ Youth Financial Literacy Luncheon on June 6. And organizers are hoping to help young people to develop good money habits now — so they don’t have to repair their finances as much as adults. RedZone Ministries, which does outreach to young people in Orange Mound, hosted about 20 students for the event, mostly middle-schoolers. The mission: To teach them the importance of understanding how money works. “We strive to serve students ages of 9-18 in a comprehensive way,” said RedZone CEO Howard Eddings Jr. “Financial literacy for kids is a big piece of what we want to provide and who we want to serve.” RedZone partnered with the Tennessee Housing Development Agency and the Shelby County Trustee Office to facilitate the event, Eddings said. And presenters made sure the education was entertaining also. Read more at the New Tri-State Defender . .This exciting 3-week intensive summer boot camp teaches 9-12 graders how to trade on the stock market as a viable form of income. Students learn in a state-of-the-art trading lab at the University of Memphis. For more information or to register, please visit, www.youngwallstreet.org

MEMPHIS, Tenn. – The Shelby County Trustee’s Office announced Bank On Memphis received a $10,000 capacity grant from the Cities for Financial Empowerment Fund (CFE Fund). The CFE Fund’s national Bank On platform supports local coalition and financial institution efforts to connect consumers to safe, affordable bank accounts. Memphis/Shelby County is one of 57 Bank On coalitions nationwide.

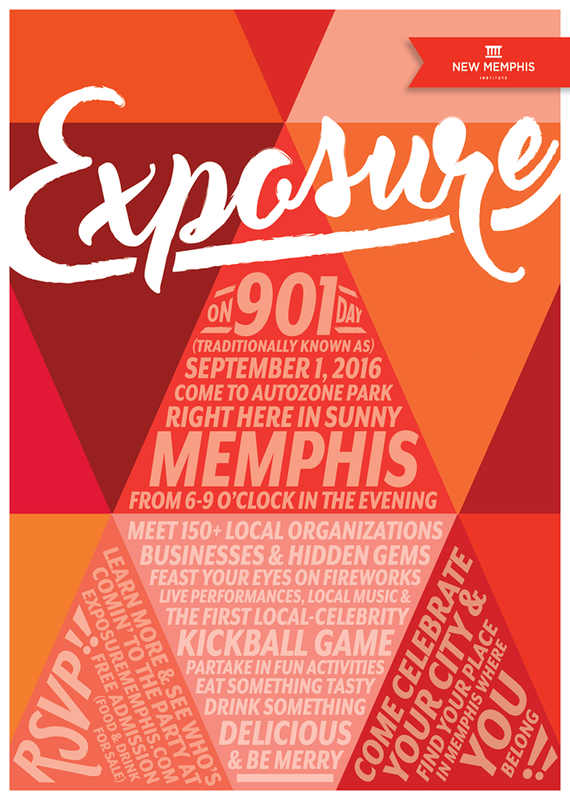

"We are grateful to receive this grant from the CFE Fund. With the help of City of Memphis, financial institutions and community partners, we have increased awareness among thousands of people and introduced them to traditional banking,” said Shelby County Trustee David C. Lenoir. "Getting this type of financial support from the national Bank On movement lets us know we are doing something right in Memphis and they want to see us continue to grow.” Bank On Memphis was established in 2011 and relaunched in 2015 with a city-wide awareness campaign and mobile app to reach low-to-moderate income Memphians who rely on alternative services like check cashers, liquor stores, and payday lenders. Financial education programming for youth was also added. To date, over 6,500 bank accounts have been opened through Bank On Memphis. On May 23rd Bank On Memphis was highlighted at the Bank On National Conference in Washington for its community outreach, innovation and successful programmatic approach of using government infrastructure to leverage large scale banking access. “Across the country, local Bank On coalitions are making critical strides connecting consumers to the financial mainstream,” said Jonathan Mintz, President and CEO of the Cities for Financial Empowerment Fund. “We are proud to award a Bank On Capacity Grant Fund to Bank On Memphis to support their efforts and enhance their work connecting Memphians to safe, affordable accounts.” # # # About Bank On Memphis: A community initiative led by The City of Memphis and the Trustee’s Office to reach the 90,000 unbanked and underbanked households in the Memphis MSA and introduce them to mainstream banking. For more information, please visit www.bankonmemphis.org. About the Cities for Financial Empowerment Fund (CFE Fund): The CFE Fund supports municipal efforts to improve the financial stability of households by leveraging opportunities unique to local government. The CFE Fund assists mayors and other local leaders to identify, develop, fund, implement, and research pilots and programs that help families build assets and make the most of their financial resources. For more information, please visit www.cfefund.org. Bank On Memphis will be partnering with RISE Foundation, Inc. at Exposure Day. Come check us out for more information about how to get involved with Bank on Memphis!

East High School senior Nigel Byrd shares his experience in an On My Own workshop with his fellow teammates this summer.

This Thursday East High Schools Football team went through an On My Own simulation and learned about how much it cost to live month to month. Trustee Lenoir spoke to the students and told them "It's not about how much you make, but how much you keep." Also, thank you to our awesome SunTrust Volunteers! Tri-State Bank is hosting a Community Bank-A-Thon (New Account) event this weekend at all 3 of their branch locations. Tri-State Bank is assisting customers opening an new checking or savings account. If you don't have time to sign-up for a new bank account this weekend, the Bank-a-Thon will also be going on August 13th and 20th. Their locations are: Whitehaven, Lamar & Airways, and Main. Stop by Tri-State Bank tomorrow to open your new bank account! Click the Button below to learn about Tri-State Banks Community Bank-a-Thon

Thanks to our Bank on Memphis Partners at First South Financial Credit Union at the Tiger Banking Center and the University of Memphis CAAS/Life Skills for hosting the On My Own Financial Education workshop! We enjoyed working with student-athletes from the Women's Volleyball team on financial literacy skills. Students were asked to imagine they were 26 years old with a simulated occupation and family scenario and worked through a months worth of expenses at 11 expense stations. Students learned the value of creating spending plans, tracking their spending and saving money in an emergency fund to be ready for those pesky "curve balls". |